Restaurant tech startup Juicer is abandoning its dynamic pricing product, saying the idea of demand-based pricing has become too unpopular with consumers.

Juicer co-founder and CEO Ashwin Kamlani said he noticed a change in the market earlier this year after Wendy’s said it planned to test dynamic pricing in the drive-thru. The brief comment during an earnings call sparked widespread backlash from consumers, who were angry about the idea of “surge pricing” being applied to burgers and fries.

Wendy’s eventually softened its original statement, saying it only planned to offer discounts during certain times of the day. But the incident stirred fear among restaurants about the risks of dynamic pricing.

“We did find that the more companies we spoke with, we started to hear, ‘I don’t want to become the next Wendy’s,’” Kamlani said.

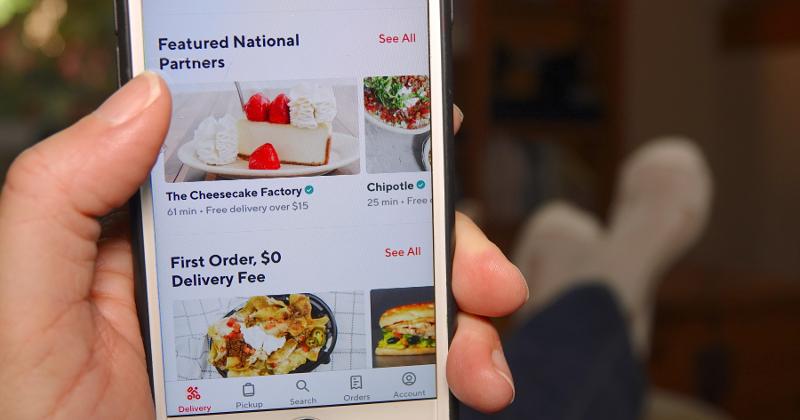

Juicer’s software allowed restaurants to make automatic, incremental price changes on third-party delivery apps. When business was slow, prices would go down; when it was busy, they would go up. The idea was to both generate additional revenue and spread demand more evenly throughout the day.

Kamlani has been a vocal advocate of dynamic pricing and maintains that it was effective for Juicer customers, citing average sales increases of 10% to 15% on delivery apps. He also said customers didn’t seem to mind the price fluctuations.

“But, should we be in the business of something that isn’t perceived to be consumer-friendly? Probably not,” he said. “We probably want to be on the right side of history here.”

[Read more: Dynamic pricing a divisive subject at the National Restaurant Association Show.]

Juicer, founded in 2021, had other factors to consider. As a startup dependent on venture capital dollars, its runway is only so long. “We didn’t have the luxury of waiting around and continuing to burn the money to sustain [dynamic pricing] to see if that would happen,” Kamlani said.

The company also happened to have another, more promising business to pivot to. Though dynamic pricing was its core product, it found that restaurants were more interested in a pricing intelligence feature it had developed. That product, now called Compete, allows restaurant chains to track the pricing and promotional activity of their competitors at the local level. It’s designed to help franchisees of large chains make informed pricing decisions for their market.

“What we’re finding is that it makes the franchisor look really good if they can easily make this information available to their franchisees in a digestible format,” Kamlani said.

Compete is now Juicer’s primary focus and accounts for 80% percent of its revenue.

Still, Kamlani did not rule out the possibility of reviving dynamic pricing at some point, though he said that it needs a rebrand.

“There’s this allergic reaction to the term dynamic pricing, and I think there’s a form of it that will be very consumer-friendly,” he said.

In the meantime, Kamlani is looking for other ways Juicer can help restaurants manage their revenue. For the next four months, he will be traveling across the country in a pink RV with a unicorn on the side and talking to restaurants about pricing.

Members help make our journalism possible. Become a Restaurant Business member today and unlock exclusive benefits, including unlimited access to all of our content. Sign up here.